By Blake Sartori

The ALP Government finally renounced the Liberal Government’s ‘Stage 3 taxes.’ That had been expected after opposing them in 2019. Took them long enough. It came just in time to stem the loss of support at the Dunkley by-election.

The political spin of these changes is something best left for the bourgeois press to fondle. The Left’s response has been either emphatic support, or silence. Both are wrong-headed. Australia’s proletariat deserve far better.

The first reaction should be easy enough to refute. The praise heaped upon the Government is enough to make one balk. Is the ACTU not able to provide even a modicum of restraint in their press releases? Clearly not! What’s more, Greg Jericho, the Australia Institute’s Chief Economist, was only too happy to praise the Government on social media for their ‘good, progressive, bold policies.’ If this is what passes for ‘bold’ around the Australia Institute, then one can only despair at what they would consider to be ‘radical’. While the social democrats heap praise, there is barely yet a peep from the socialists about the inadequacy of fiddling at the fringes. While praise is clearly not warranted, neither is silence.

Let us explore some of the points that need to be made.

Let us be clear of the substance regarding these changes. The former Stage 3 tax deforms were a blatant redistribution of the tax burden towards the low and middle levels of wage-and-salary earners. Originally, the top 3% of income earners were set to benefit by a $9,075 reduction in their taxes. The section of the proletariat earning under $45,000 would not have got a cent. The changes made by the ALP Government are more equitable than the initial tax cuts for the well-to-do crew. How bold for the ALP to scale the summit of the Liberal’s low bar.

A chance to talk of the hypocrisy of state finances has once again been squandered. Instead, these changes have been framed as a way to tackle the ‘cost-of-living crisis’. This ‘crisis’ did not come about from personal income taxation being too high. What has it come from then? Rents in Victoria have increased by 14.3% over the year to September 2023 , not because of taxation, but because of greedy landlords exploiting a rigged housing ‘market,’ and because of the Reserve Bank’s pursuit of higher interest rates. These moves are said to tackle inflation by removing spending power from the proletariat. The real effect of this drive has been to funnel money into higher mortgage repayments – benefiting the balance sheets of the Big Four banks and real-estate sharks.

Should housing not be front and centre of your budgeting, grocery prices are the likely next culprit – increasing by 4.5% over the 12 months to the December quarter 2023 . It is well known that Australia’s fresh produce sector does not suffer from a lack of supply. With approximately 10% of perfectly edible food forced to be discarded because of the insane beauty standards of Australia’s supermarkets .These standards are nothing more than a crude measure to stave off below average rates of profit by artificially inflating prices.

If it is not housing or groceries, then we turn our attention to energy prices. Here is another ‘market’ subjected to past sell-outs to corporate capital and thus now in the hands of an oligopolistic minority. Even the Victorian Essential Services Commission conceded that the 2023-24 default offer for ‘domestic customers’ will be an increase of 25% compared to 2022-23 . No need to labour the point further.

These three heads of consumption, necessary for the reproduction of labour power, are in the hands of capital, hands whose grip tightens ever further. Taxes will not loosen this grip. Do not disrespect us by insinuating so.

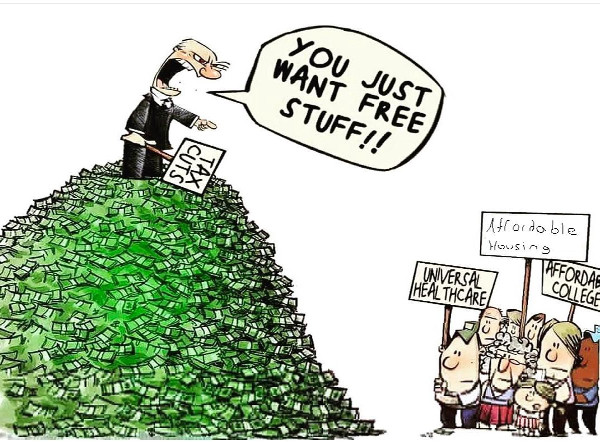

The chit-chat around taxation deforms misses entirely the dynamics of control at play. By focusing on income, wealth is ignored. This short-sightedness may or may not benefit those earning over $200,000 per annum. But it certainly benefits the bourgeoise sitting upon their investments, the productive sources of their wealth. The question of ownership has gone missing, lost to the background once more.

If the Left is to talk about taxation, then perhaps its vigour is better directed towards corporations which plunder the land for resources – and pay so little in doing so. It has been 50 years since the Fitzgerald Report was released – not to be confused with Queensland’s Fitzgerald Inquiry. In 1973, the new Minister for Minerals and Energy, Rex Connor, sought to establish what had the latest mining boom, that began in 1957 with bauxite around Weipa, contributed to Australian welfare. The assumption at the time, and which is still prevalent today, had been that the State and Federal Governments had received more back in taxes than what had been given over as subsidies and granted as investment allowances to. When the Fitzgerald Report came in April 1974, the numbers showed otherwise. Governments had got nothing. In fact, the rest of us had been forking out to pay BHP and CRA-RTZ to profit from exporting finite resources. Calculations varied from $5m up to $55m, but there was no doubt that we taxpayers had been subsiding the mining giants. Proof positive came when the Bjelke-Petersen government reacted by driving up freight rates for the coal companies.

Soon after the Fitzgerald Report’s release, the Coalition said the quiet part out loud, opposing the potential of the Whitlam Government establishing a state-owned Petroleum and Minerals Authority: “It is therefore specious to justify the authority because the Labor Party disapproves of the way some companies have conducted their affairs in the past. Government can easily correct this situation through the taxation and other guidelines it sets down for the industry.” Take heed – taxation is not the path to socialisation!

More recently, some on the ‘left’ have been more vocal about the real contribution made by the minerals and fossil-fuels sector to the Australian people. Participating in the ABS’s program The Drum in 2023, Polly Hemming (Director of Australia Institute’s Climate and

Energy Program), exposed Australia’s gas industry by stating “If anything, it [Australia’s gas industry] costs the Australian economy.” In early 2023, she and the Institute’s Mark Ogge had shown that, not only was demand for gas falling – and forecast to remain below 100 petajoules (pj) with the main driver of demand and being the gas industry itself – but also that exports for Australian gas were to remain at over 1,300pj until the mid-2030’s . The tale here is yet another saga of subsidies, private profits and little to no net tax. Hegel remarks somewhere that all facts and personages of great importance in world history occur, as it were, twice. He forgot to add: the first time as tragedy, the second as farce .

Back to the matter at hand. The Left should not pile praise upon the ALP Government for these tax deforms, nor must we remain silent. A clear and coherent message is needed. We must connect the ‘cost-of-living crisis,’ not to taxation, but to ownership and control over the means of production and distribution. Demanding higher wages is a start – agitation within one’s union and amongst one’s workmates for industrial action to achieve higher wages. We cannot rely on the ALP to hand around benefits. Lasting change will come only through mass struggle.